This blog article is inspired by the scientific article: R. Miclo, F. Fontanili, M. Lauras, J. Lamothe and B. Milian, “An empirical comparison of MRPII and Demand-Driven MRP”. Proceeding of the 6th MIM conference, June 2016.

Everybody knows about Manufacturing Resource Planning (MRPII); created in the 1970s, it is the most widespread planning method in the world.

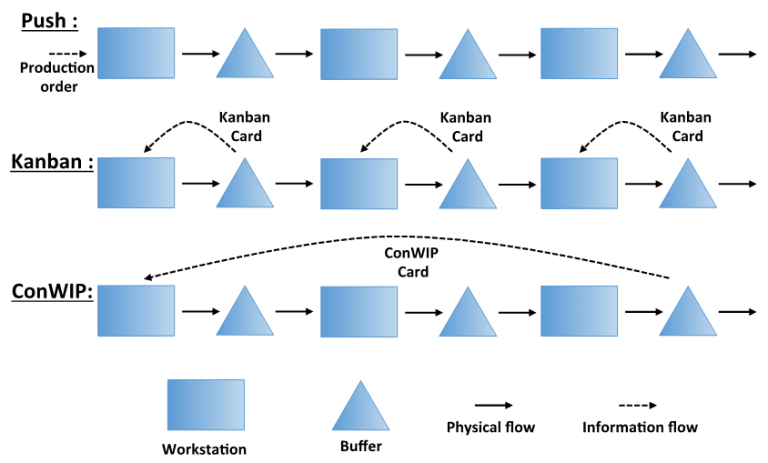

This methodology plans the manufacturing activities of a company based on demand forecasts: it is what we call a “push flow method”. MRPII is built on multiple processes from strategic to operational levels, from business planning, to capacity requirements planning.

However, markets have drastically evolved for the last 30 years, with a highly instable demand from customer, resulting in high nervousness through all Supply Chains; this is the famous “bullwhip effect”.

To solve this problematic, industrials tried to move from a “push flow” method to a “pull flow method” such as Kanban or ConWIP (Constant Work in Process).

Since 2011, another promising method has appeared: Demand-Driven MRP aims at positioning and dimensioning buffers in order to lower variability sources in the Supply Chains.

But is it truly more efficient than that good old chap MRPII ?

The case study is based on Kanban serious game from the “Centre International de la Pédagogie d’Entreprise“ (CIPE). A Discrete-Event Simulation (DES) approach is retained to get predictive results. The tool will process different scenarios, and show the impact of MRPII strategy vs DDMRP strategy, regarding On-Time Delivery (OTD) and Working Capital (WC, valuation of Work in Process and stocks). Several sources of variabilities are combined: internal (instability of operating times and setups) and external (spike demand and seasonality of demand).

The case study represents a company producing reducers made of three parts. The goal is first to achieve 100% of OTD (minimum of 99,3%), then to minimise the Working Capital.

5 scenarios have been tested as follow:

Table 1: Simulation scenarios

The following table shows the results between MRPII strategy and DDMRP strategy. The reference scenario is Scenario 1 with MRPII policy, set as base 100.

Table 2: Scenarios assessment

The objective OTD is nearly always satisfied with DDMRP policy. MRP II also reaches satisfactory OTD levels for all scenarios except when demand variability becomes too high (Sc5). Furthermore, it can be clearly seen that DDMRP requires less Working Capital to achieve the OTD objective. Moreover, it has been demonstrated that DDMRP is highly stable when facing variabilities, unlike MRPII.

DDMRP shows smaller and more stable replenishment orders than MRPII, both in size and in components needed. As a consequence, the frequency of orders is higher for DDMRP than for MRPII: however this does not generate a so big increase in the number of setups for the machines.

Therefore, the case study demonstrates that DDMRP is fully effective in regulating the system variability.

On top of that, it has been showed that the stocks distribution is better with DDMRP; stocks are centred on the optimal stock level, unlike MRPII were stock distribution is bimodal : either too much or too low.